Stash, the finance app favored by first-time investors who are just learning the market, is getting into banking. The company announced this morning it will roll out a set of mobile-first banking services aimed at those left behind by traditional banks. The services include bank accounts with debit cards, no overdraft fees, access to a network of free ATMs across the U.S., as well as financial guidance on spending, saving, investing, and planning for retirement.

The startup itself isn’t becoming a bank, however. Instead, it has partnered with Green Dot Corporation and its subsidiary, Green Dot Bank, which is where the accounts will actually be housed. That means Stash accounts are protected by FDIC insurance, like any other bank.

The introduction of banking services in Stash comes at a time when the finance app market has begun to swiftly capitalize on younger users’ disinterest in standard banks with their physical branches and high fees, as well as millennials’ savvy use of technology for managing money.

There’s also increased interest from major players in finding new ways to serve the under-banked and unbanked – people who today often rely on payday lenders and check cashers, instead of having their own bank accounts.

In recent weeks, Amazon was reported to be in discussions with banks about its own launch of consumer-facing banking services, for example. And just days ago, PayPal announced its own launch of banking products for the unbanked. In addition, peer-to-peer money transfer apps – including PayPal’s Venmo and rival Square Cash – have been edging their way into banking with by handing out debit cards to users, which are tied to their online accounts. And there are now numerous digital banking services to choose from, for those who don’t need a bank with branches – like BBVA’s Simple, Chime, and Varo Money.

In other words, Stash will have some competition.

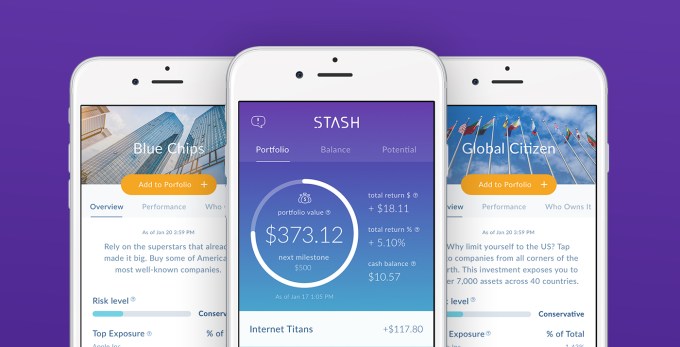

However, the company’s advantage here is that it’s not just a banking services provider – it’s also offering services that help teach people how to invest, save, and plan for their future, and can automate much of the activity required to build up your emergency funds or IRA.

The company aims to bring similar insights to its banking services, allowing people to view personalized insights about their spending behavior, and leverage its “Stash Coach” technology for financial guidance.

Stash, which just announced a $37.5 million Series D in February, had said then that its next steps would involve a move into banking. It claimed 1.5 million customers at the time of the raise – a figure that’s now grown to 2 million. It’s also says around 40,000 new clients are joining weekly.

The average Stash user is 29, but the company’s broader vision is to go after anyone – not just millennials – in need of simpler, mobile tools for banking, saving and investing.

“There are more than 100 million Americans who need a banking product just like the one we are building with Green Dot. Stash is committed to being a true partner and source of support for our clients, and for those who have systematically been left behind,” said Brandon Krieg, Stash’s co-founder and CEO, in a statement.

Stash’s announcement today is focused on its partnership with Green Dot, but it didn’t say when the banking services would actually go live in the app for all users. It also hasn’t yet disclosed its fee structure – something the company tells us will be disclosed more specifically when banking services are closer to launch

In the meantime, Stash’s app for investors is a free download on iOS and Android.