Latin America faces a unique opportunity to develop the next generation of tech startup stars. Market conditions such as Internet and mobile Internet user growth outpace the US. And a GDP of 9.5T is bigger than India and almost the same as China. Also, banks and industrial complexes still dominate the market, leaving plenty of space to conquer the future. We could argue that these are obvious assumptions and that not much has changed. But something has changed.

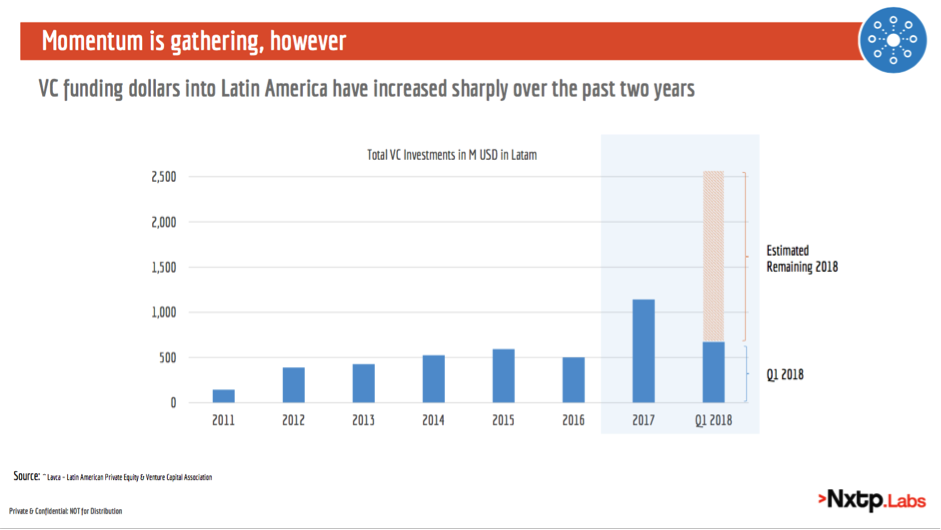

VC funding records in the region

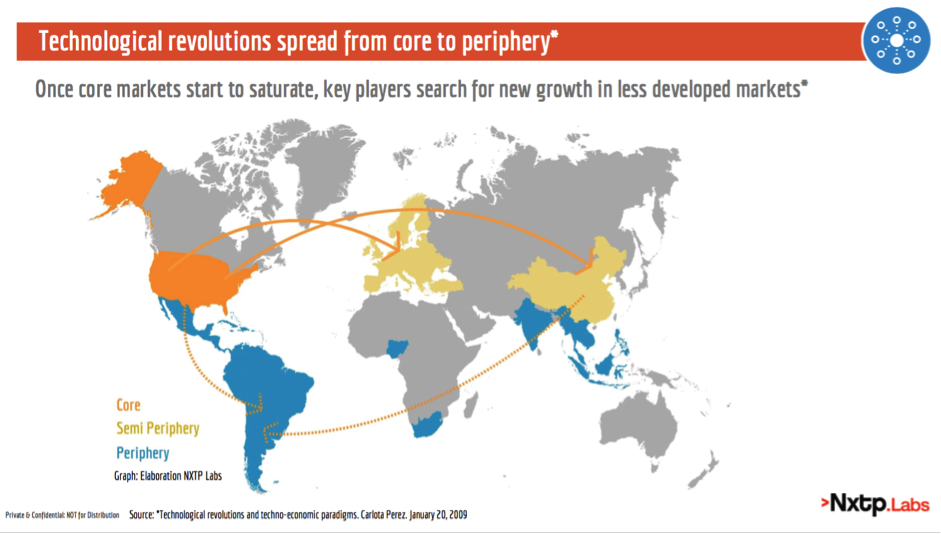

We’re currently going through the maturity phase of the Internet technological revolution. According to Carlota Perez’ work, this is the moment when core markets become saturated and the set of technologies and financial capital moves towards the periphery: towards the less advanced countries.

And recent changes in the regional investment landscape suggest this is happening. In 2017, VC tech investment in the region had an all time high of $1.1B. A major breakthrough when we compare it to the five previous years, which had remained steady at around $500M. This trend continues today, with over $600M invested only during the first quarter of 2018.

Mega rounds are real

The funding record can be partially explained by the appearance of mega rounds in the region. For the first time, companies are raising rounds of $100M plus. 99 (acquired by Didi Chuxing), Nubank and Rappi, have all raised mega rounds in the past two years. Others have raised large rounds, such as Selina and Movile, with plus $90M plus, or Auth0 (part of our portfolio), with plus $50M rounds in 2018. But the increase in dollar amounts is not only driven by mega rounds. More than 30 transactions of $3M or more happened in 2017, which is triple in amount of rounds of that figure when compared to 2016. This shows a market maturity not seen before]=

International VCs presence grows

Global VC firms have timidly invested in the region for the past years. But this is has also changed. There are several new players and old suspects looking for opportunities. Some of those are Andreessen Horowitz, Sequoia Capital, Accel Partners and Softbank, not to mention strategic investors such as Didi Chuxing. In 2017 alone, more than 25 new global VC firms entered the region.

Ecosystem development

To make the most out of the maturity phase of technological revolutions, VC dollars are not enough. Other complimentary conditions must be met. Conditions that can amplify the impact of a new flow of capital. As Perez’ says: physical, social and technological infrastructure and the existence of competent and demanding local clients must also be met. As mentioned before, conditions such as Internet usage and wealth are a reality. Also, amount of smartphone users and e-commerce buyers are reaching US levels. But one other condition has changed: institutional support.

Institutional Support

In the 2010’s regional ecosystems were boosted by the appearance of new VC firms and accelerators. Together they created a fertile ecosystem that gave birth to a new class of Latin American startups. As time passed, local Governments and institutional investors support also became a reality. Through different programs, funding lines and regulatory changes, they now support the development of local ecosystems. A few examples are Startup Chile, Mexico’s Fund of Funds, Brazil’s BNDES, and the recent Entrepreneurs Law bill passed in Argentina. Also, Institutional Investors such as IADB or CAF are active in the region, both as LP’s, as direct investors and through different lines of credits and grants.

Wrapping up

Maturity signs are observed in Latin America for the first time. Increased funding, liquidity events, a solid entrepreneurial base, and increased institutional support are a reality. Public tech companies are catching up old incumbents: Mercadolibre, Despegar, Globant and B2W doubled their combined market cap in 2017 to USD 34B. And new rising tech startup stars such as 99 and Nubank are born. This is a unique time. And a unique opportunity. Latin America is poised for a new wave of tech companies to become market leaders. And this is just the beginning.