WeLab, an financial tech startup that operates online lending platforms in Hong Kong and China, has raised $220 million in combined equity and debt financing. The round, which WeLab says is its Series B+, brings its total funding so far to $425 million. Investors include the Alibaba Hong Kong Entrepeneurs Fund, the World Bank’s International Finance Corporation (IFC) and Credit Suisse,… Read More

WeLab, an financial tech startup that operates online lending platforms in Hong Kong and China, has raised $220 million in combined equity and debt financing. The round, which WeLab says is its Series B+, brings its total funding so far to $425 million. Investors include the Alibaba Hong Kong Entrepeneurs Fund, the World Bank’s International Finance Corporation (IFC) and Credit Suisse,… Read More

Category: finance

Square’s dominant year hits a snag

Square is continuing to make its bid to capture the payments of small businesses around the world, as well as tap into the momentum of peer-to-peer payments products with Square Cash, as its payments volume continues a steady and methodical rise — though, Wall Street still seems a little skeptical today. Square’s gross payments volume, a critical metric for the company’s… Read More

Square is continuing to make its bid to capture the payments of small businesses around the world, as well as tap into the momentum of peer-to-peer payments products with Square Cash, as its payments volume continues a steady and methodical rise — though, Wall Street still seems a little skeptical today. Square’s gross payments volume, a critical metric for the company’s… Read More

BitTorrent inventor announces eco-friendly Bitcoin competitor Chia

A Bitcoin transaction wastes as much electricity as it takes to power an American home for a week, and legendary coder Bram Cohen wants to fix that. And considering he invented the ubiquitous peer-to-peer file transfer protocol BitTorrent, you sh…

View More BitTorrent inventor announces eco-friendly Bitcoin competitor ChiaRevolut is applying for a European banking license to become a true bank

It’s hard to believe that fintech startup Revolut still doesn’t have a proper banking license. Many users will tell you that Revolut’s electronic wallets already feel like traditional bank accounts with an IBAN and a payment card. But the startup is finally applying for a proper banking license in Lithuania. This process is going to take a few months — the startup… Read More

It’s hard to believe that fintech startup Revolut still doesn’t have a proper banking license. Many users will tell you that Revolut’s electronic wallets already feel like traditional bank accounts with an IBAN and a payment card. But the startup is finally applying for a proper banking license in Lithuania. This process is going to take a few months — the startup… Read More

Snap is having a bad day

Ho boy — there are bad days and there are bad days in earnings season, and this is definitely the latter for Snap. The company released its quarterly report for its financial performance in the third quarter this year, and as a result, the company’s stock is absolutely cratering. It’s bad even by recent-IPO status, which are especially vulnerable to swings in shares as… Read More

Ho boy — there are bad days and there are bad days in earnings season, and this is definitely the latter for Snap. The company released its quarterly report for its financial performance in the third quarter this year, and as a result, the company’s stock is absolutely cratering. It’s bad even by recent-IPO status, which are especially vulnerable to swings in shares as… Read More

Snapchat share price craters on weak revenue and user growth in Q3 2017

Snap’s losing streak continued with today’s Q3 2017 earnings report that saw it miss financial expectations and add just 4.5 million users. Snap earned $207.9 million in revenue with a loss of $0.14 per share, compared to expectations of a $237 million in revenue and a loss of $0.15 EPS. The 178 million total daily users equates to a 2.9% quarter-over-quarter user growth rate… Read More

Snap’s losing streak continued with today’s Q3 2017 earnings report that saw it miss financial expectations and add just 4.5 million users. Snap earned $207.9 million in revenue with a loss of $0.14 per share, compared to expectations of a $237 million in revenue and a loss of $0.15 EPS. The 178 million total daily users equates to a 2.9% quarter-over-quarter user growth rate… Read More

Acorns to launch new retirement accounts after buying Portland fintech startup, Vault

Micro-investment service, Acorns, which automatically invests small amounts from its customers’ bank accounts into investment funds, has bought Vault, a Portland-based developer of retirement fund investment services. Vault’s application lets its users set aside part of their paychecks into retirement funds. The deal is a solid compliment to Acorns’ own investment app, which… Read More

Micro-investment service, Acorns, which automatically invests small amounts from its customers’ bank accounts into investment funds, has bought Vault, a Portland-based developer of retirement fund investment services. Vault’s application lets its users set aside part of their paychecks into retirement funds. The deal is a solid compliment to Acorns’ own investment app, which… Read More

Neos launches IoT-powered home insurance UK-wide

What do you get if you combine the Internet of Things with the business of home insurance? U.K. startup Neos is hoping the answer is damage and/or theft prevention rather than just after-the-unfortunate-fact payouts. Read More

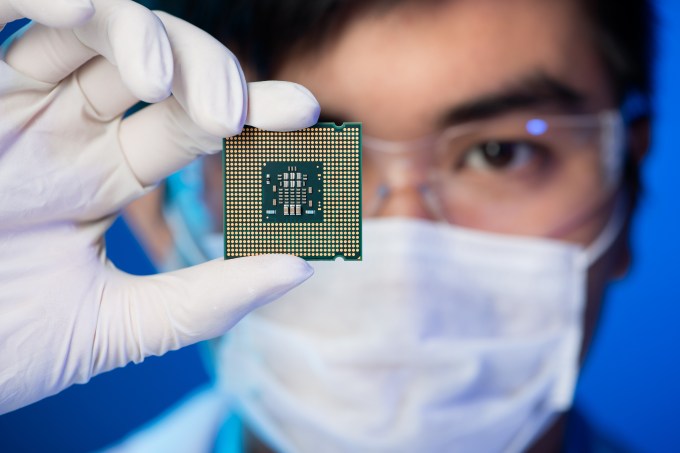

View More Neos launches IoT-powered home insurance UK-wideA tale of two chip stocks

Broadcom confirmed this morning that it would offer to acquire Qualcomm in one of the largest tech deals of all time, and one that would consolidate two storied semiconductor companies into a single unit as the chip world has begun a course shift in the past year. But it’s as much a story of a potential consolidation of fabless semiconductor giants as it is one of the performances of… Read More

Broadcom confirmed this morning that it would offer to acquire Qualcomm in one of the largest tech deals of all time, and one that would consolidate two storied semiconductor companies into a single unit as the chip world has begun a course shift in the past year. But it’s as much a story of a potential consolidation of fabless semiconductor giants as it is one of the performances of… Read More

Apple offers more bonds to finance its $300 billion capital return program

Apple just started selling new bonds in order to finance a share buyback program and dividends for shareholders, as Bloomberg spotted in a filing. This is counterintuitive as Apple is sitting on a big pile of cash and probably doesn’t need to issue bonds. But most of the company’s cash is outside of the U.S. During Apple’s fourth-quarter earnings call, the company said that… Read More

Apple just started selling new bonds in order to finance a share buyback program and dividends for shareholders, as Bloomberg spotted in a filing. This is counterintuitive as Apple is sitting on a big pile of cash and probably doesn’t need to issue bonds. But most of the company’s cash is outside of the U.S. During Apple’s fourth-quarter earnings call, the company said that… Read More

Aquantia up 6% following semiconductor IPO

Tech IPOs have been picking up lately and one lesser-known semiconductor company, Aquantia, made its debut on the New York Stock Exchange today.

Tech IPOs have been picking up lately and one lesser-known semiconductor company, Aquantia, made its debut on the New York Stock Exchange today.

The company raised $61 million in its offering, after pricing shares at $9.00. It closed the day of trading at $9.51.

The San Jose, California-based company describes itself as “a leader in the design, development and marketing of advanced… Read More

Equity podcast: Apple and Tesla report earnings, and IPOs are back

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines. This week was a treat due to the huge news cycle we followed. So, Katie Roof and I — Alex Wilhelm — brought David Golden into the studio to help us carve through it all. Golden is a managing partner at Revolution Ventures, an investing shop… Read More

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines. This week was a treat due to the huge news cycle we followed. So, Katie Roof and I — Alex Wilhelm — brought David Golden into the studio to help us carve through it all. Golden is a managing partner at Revolution Ventures, an investing shop… Read More