Coya, a Berlin-based insurance startup, has raised $30 million in new cash as investors around the world continue to see opportunities in modernizing the insurance industry. Founded by two early employees at the European credit and risk assessment unicorn startup Kreditech (which raised EUR110 million from the Naspers subsidiary PayU) and two seasoned executives from […]

View More Coya raises $30 million to launch its insurance service in EuropeCategory: personal finance

Vota turns your credit card transactions into recommendations, helps you spot fraud

Oh my god, someone’s doing Blippy again. If you’ve been around the internet as long as I have (too long), you’ll probably remember the meteoric rise of the social network for sharing your purchases, Blippy, which was hyped up to a $46.2 million valuation back in 2010 before the world realized that almost nobody wanted […]

View More Vota turns your credit card transactions into recommendations, helps you spot fraudCiti FinTech lets consumers define the future of banking

/https%3A%2F%2Fblueprint-api-production.s3.amazonaws.com%2Fuploads%2Fstory%2Fthumbnail%2F72799%2Fb3a24537-37ee-4a84-bc17-b4e9ada7df22.jpg)

Advertising Content from Citi

Technologies that champion customization and co-creation are rapidly transforming modern society. Everyday tasks from how you select a new pair of running sneakers to managing your finances are becoming more personalized. This trend is catalyzing a paradigm shift — directing focus away from one-size-fits-all experiences and putting creative power in the hands of consumers.

“Banking has reached an inflection point with the merging of financial services and technology, or FinTech,” said Carey Kolaja, Global Chief Product Officer for Citi FinTech. “But innovation can’t be fueled by technology alone. Our customers are crucial to the ideation and creation process, so we’ve included them since day one and are always looking for new and better ways to incorporate their insights as we design our digital products. This co-creation process is now at the heart of everything we do.” Read more…

More about Supported, Personal Finance, Banking, Fintech, and Citi

View More Citi FinTech lets consumers define the future of bankingMobile money-saving app Qapital raises $30 million to spend on growth

Qapital, one of a slew of mobile applications trying to make it easier for users to save money (and spend it more wisely), has raised $30 million in fresh financing as it expands beyond savings to offer investment advisory services. Since its launch in the U.S. in 2015, Qapital has amassed roughly 420,000 users that […]

View More Mobile money-saving app Qapital raises $30 million to spend on growthThe investment inequality that’s just as important as the gender wage gap

/https%3A%2F%2Fblueprint-api-production.s3.amazonaws.com%2Fuploads%2Fcard%2Fimage%2F729445%2Fcb3ce393-7fd3-416f-b8fe-0fe314c5393c.jpg)

The gender pay gap — or the statistic that women make approximately 80 cents for every dollar that men make — is a well-documented phenomenon, backed up by data from the U.S. Census Bureau and the American Association of Women.

Arguably as pressing an issue is the gender investment gap: Many women are less prepared for long-term financial health than their male counterparts.

Women have the potential to add $12 trillion to the global economy over the course of the next decade, so helping them use their assets advantageously is a win-win for all. Below, we take a deeper look at the gender investment gap and how to begin to close it. Read more…

More about Supported, Personal Finance, Gender Equality, Sponsored, and Financial Advice

View More The investment inequality that’s just as important as the gender wage gapHere’s how predictive technology will help you meet your New Year’s money resolutions

/https%3A%2F%2Fblueprint-api-production.s3.amazonaws.com%2Fuploads%2Fcard%2Fimage%2F692713%2F9c12c11f-8fee-4f9b-b1b2-23fb6c94407e.jpg)

The start of the New Year often brings resolutions for better managing our financial health. But without a clear plan on how to actually grow savings and manage our money better, we tend to default to our day-to-day routine, where actively managing our finances falls to the wayside.

Actively saving for the future isn’t something most people are doing, regardless of the time of year. In fact, living paycheck-to-paycheck is more common than you think. Whether we’re overindulging in retail therapy, leaning too heavily on credit cards, or not understanding the basics of good financial planning, our approach to saving could use a refresh. Read more…

More about Supported, Personal Finance, Banking Apps, How To Save Money, and Tech

View More Here’s how predictive technology will help you meet your New Year’s money resolutionsMoneyLion raises $42M to grow its personal finance platform for the middle class

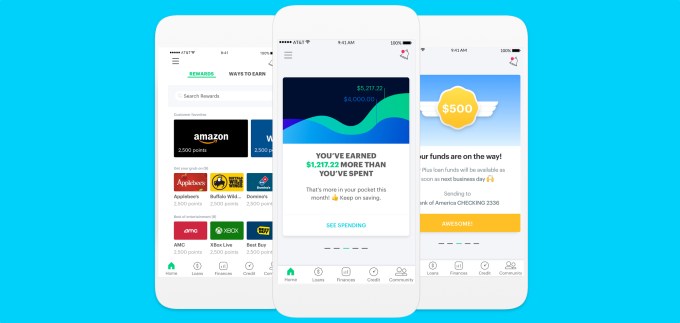

MoneyLion, the part lending, part savings and part wealth management app targeted at the financial middle class has raised $42M in Series B funding.This brings total equity funding to $67M since being founded in 2013.

MoneyLion, the part lending, part savings and part wealth management app targeted at the financial middle class has raised $42M in Series B funding.This brings total equity funding to $67M since being founded in 2013.

The startup provides an all-in-one platform for anything finance related. A user connects their bank accounts and credit cards and then gets personalized advice based on their… Read More